- HOME

- Sustainability

- Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Understanding Climate Change

Climate change is currently recognized as one of the most significant threats to the sustainable development of global society. The Fifth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), released over the course of 2013 and 2014, states that human activities are extremely likely (at least 95%) to be the main cause of global warming and climate change. Subsequently, the IPCC Sixth Assessment Report, released in August 2021, states that it is unequivocal that human activities are the main cause of global warming and climate change.

Based on these scientific views, a debate on how to deal with climate change has raged across the world. At the Conference of the Parties (COP21) of the United Nations Framework Convention on Climate Change (UNFCCC) in 2015, the Paris Agreement was adopted to pursue efforts to limit global warming to well below 2, preferably to 1.5°C, compared to pre-industrial levels. Under the Paris Agreement, countries have set targets for reducing greenhouse gas (GHG) emissions and are implementing a variety of climate change-related measures. For example, in Japan, where our Group mainly operates, the government declared its goal in October 2020 to achieve carbon neutrality by 2050.

The impact of climate change on the global economy and corporate activities is becoming increasingly severe with each passing year. Accordingly, shareholders and investors are facing a growing urgency to assess how the businesses and plans of each company will be affected by climate change. Recognizing the need for a common global framework that facilitates an appropriate assessment of the risks and opportunities of climate change for each company, the TCFD was established to promote disclosure of information on climate change in response to requests from the G20 and national central banks. It released its final report in June 2017 and has been encouraging companies to disclose information on climate change.

Approach and Policies

In light of these circumstances, the Group established its sustainability policy “Earth Pride,” which describes its vision of 2050.

Under our Group vision “New Value, Real Value,” the Group has been promoting its business activities through the collaboration of real estate development and real estate-related services. The sustainability policy is our commitment to the Earth—to make it a planet we can be proud of toward the future, specifically 2050—when conducting our corporate activities.

The concept of Earth Pride is based on the three themes that the Group values: pursuing humanity, maintaining harmony with nature, and building the future together.

This sustainability policy verbalizes the Group’s vision of 2050 as a corporate group that realizes a sustainable society and corporate growth. Numerous people, including middle-level and younger employees, those in managerial positions, the management team of the Group, external institutional investors and financial institutions, our clients, and business partners and experts, provided input in formulating this policy.

To realize this vision of 2050, we have identified five priority issues (materiality) that should be addressed by 2030. These are diversity and inclusion, human rights, decarbonization, biodiversity, and circular design.

Targets

| Climate Change and the Natural Environment | Contribution to the urgent global issue of reducing CO2 emissions, biodiversity preservation, and the realization of a circular society that contributes to CO2 reduction | |||||

|---|---|---|---|---|---|---|

| Decarbonization | Initiatives in energy saving, low-carbon business, and utilization of renewable energy <Target: 35% reduction in Scopes 1, 2, and 3 by FY2030 compared to FY2019 > |

|||||

| Biodiversity | By restoring the forest cycle in Japan, contribute to CO2 absorption and the natural environment through urban afforestation and forest preservation, thus enabling rich biodiversity | |||||

| Circular Design | Contribute to a decarbonized society and a circular economy through urban development and service provision that incorporate longer lives of properties, recycling, and sharing | |||||

| Society and Employees | Strengthening the foundation for promoting sustainability for co-creation that transcends organizations and business categories | |||||

|---|---|---|---|---|---|---|

| Diversity and Inclusion | Create an organization that enables diverse workers, including women and foreign nationals, with various backgrounds and values to make meaningful contributions | |||||

| Human Rights | Solidify a corporate foundation of mutual respect for the dignity and basic human rights of every employee and business partner | |||||

Climate Change and the Natural Environment

We contribute to address the global issue of climate change through urban development and the provision of products and services based on the collaboration of real estate development and real estate-related services. We also specified priority issues that could lead to the preservation of the natural environment. In addition, the Group has proactively participated in international initiatives such as obtaining approval from the SBT initiative (35% reduction from fiscal 2019), supporting the TCFD, and joining RE100.

Decarbonization

We reduce total CO2 emissions in the properties developed by the Group through the promotion of energy saving, low carbon, and renewable energy.

Main initiatives:

We aim to further improve energy conservation performance ensuring the level of performance equivalent to the ZEH/ZEB oriented standards.

We conduct research and development to promote low-carbon materials through co-creation with construction companies and building materials makers.

We contribute to increasing renewable power generation that achieves additionality such as the installation of solar panels on the roofs of the buildings developed by the Group (e.g., logistics facilities).

We aim to respond to climate change through urban development. For instance, we will achieve carbon neutrality in the Shibaura 1-Chome Project (the south tower to be completed in fiscal 2024 and the north tower to be completed in fiscal 2030). We will also create a next-generation energy exchange facility in the project with the Research Center for Advanced Science and Technology, The University of Tokyo.

Approach and Policies on Climate Change

The Nomura Real Estate Group uses land and other natural resources and energy in the course of conducting business activities, and it is fully aware that the substantial impact of climate change on its business continuity is a major management issue. In September 2020, Nomura Real Estate Holdings, Inc. (head office: Shinjuku-ku, Tokyo; president and Group CEO: Satoshi Arai) announced its endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and joined the TCFD Consortium of Japan.

Governance

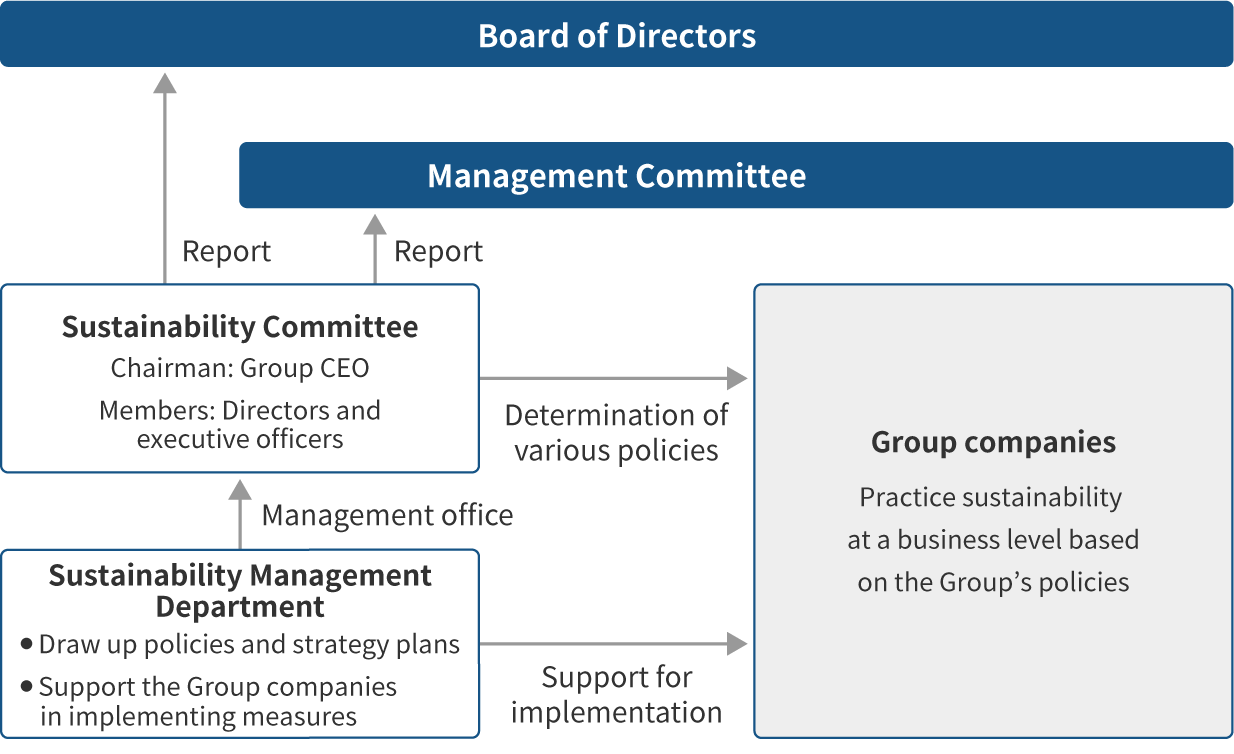

The Sustainability Committee, which comprises Nomura Real Estate Holdings and Group company directors and others, and is chaired by the Nomura Real Estate Holdings president and Group CEO, deliberates Group-wide policies and targets related to climate change. The committee is positioned as a subordinate committee of the Management Committee and holds at least three to four meetings each year. It reviews risks and opportunities associated with climate change and examines and monitors the Group’s GHG reduction targets. Details of deliberations made by the committee are reported to the Board of Directors and Management Committee at least twice a year. In addition, any key matters related to the Group’s management are reported to the board and committee as necessary.

As mentioned above, the Nomura Real Estate Holdings president and Group CEO is responsible for promoting measures to address sustainability and climate change throughout the Group. The Group CEO is the chief executive officer of the Board of Directors and Executive Committee and is responsible for making the best decisions to achieve the sustainable growth of the Group as a company, including addressing sustainability and climate change, and for executing key related operations.

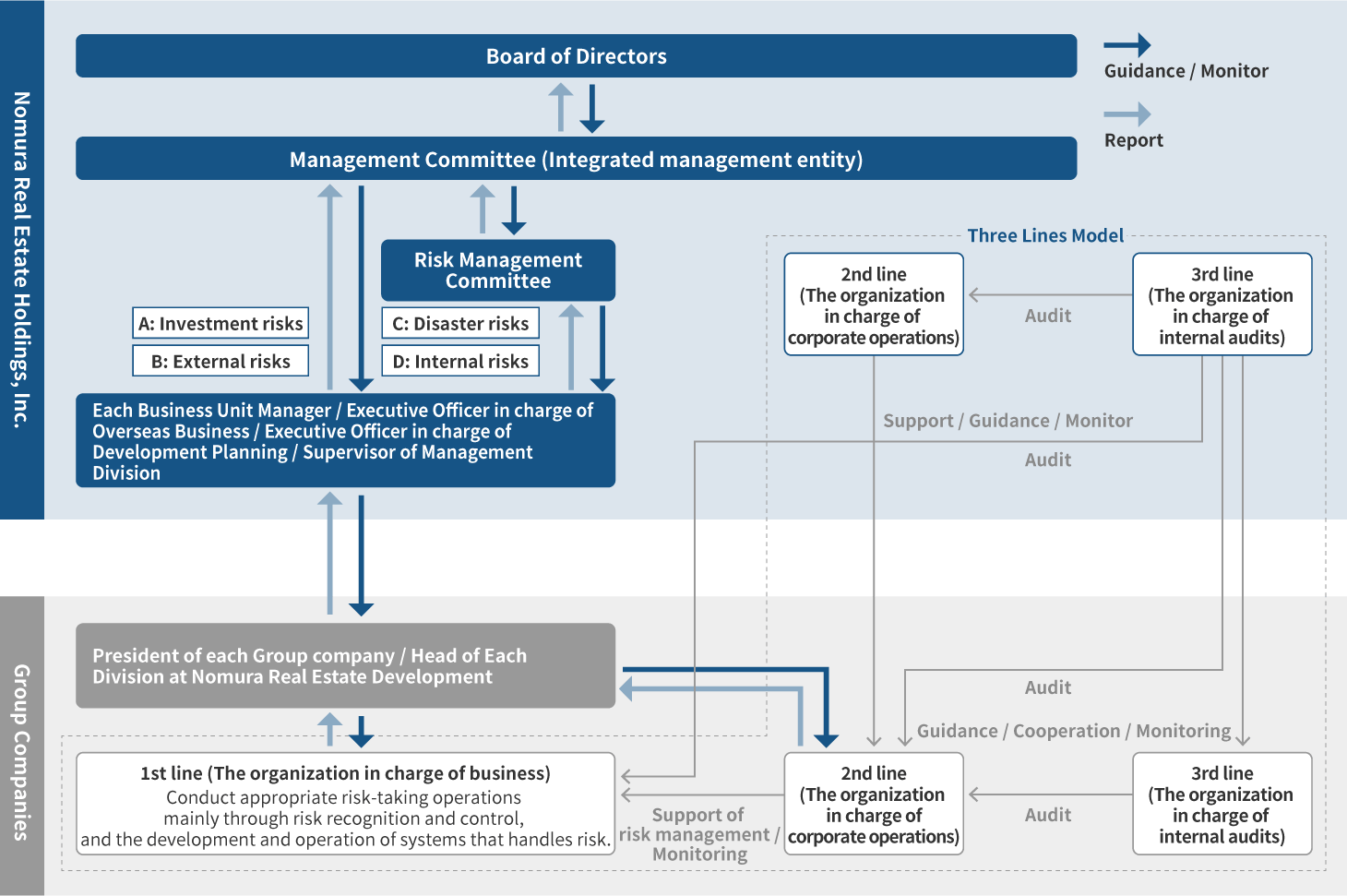

In addition, our risk management system also manages climate change-related risks.

| Risk Category | Definition | |

|---|---|---|

| (A) | Investment risk | Risk related to individual investments (real estate investment, strategic investment (M&A), etc.) |

| (B) | External risk | Risks related to external factors influencing business |

| (C) | Disaster risk | Risks generated by disasters that have a large impact on customers and business continuity |

| (D) | Internal risk | Operational risks occurring at the company and each Group company |

To discuss various risks related to Group management, the Company has prescribed the Management Committee as the integrated risk management body and operates a system to regularly monitor, evaluate, and analyze the state of main risks and provide necessary guidance and advice to each business unit and Group company while regularly reporting details to the Board of Directors. The committee, which is the integrated management body, directly monitors investment risk and external risk, while the Risk Management Committee, established as a subordinate organization of the Management Committee, conducts regular monitoring, evaluation, and analysis of disaster risk and internal risk and discusses basic response policies regarding risk prevention, responses when risk occurs, and prevention of recurrence. Risks related to climate change are positioned under the following categories managed as part of our business risks: risk from lagging behind innovation and changes in the social structure related to the business (category of external risk) and risk caused by disasters (earthquakes, typhoons, floods, tsunamis, volcanic eruptions, major fires, epidemics of infectious diseases, etc.) that have a major impact on customers and business continuity (category of disaster risk).

Each business unit closely monitors social trends related to climate change, such as changes in customers and markets and revised regulations. They also identify risks and opportunities in climate-related issues and examine and implement associated actions at the operational, business, and product levels. One example is the planning of Net Zero Energy Houses (ZEHs) and Net Zero Energy Buildings (ZEBs) based on changes in the market and customer needs, technology trends, and other factors. Of these initiatives undertaken by each business unit, those deemed particularly important to management are reported to the Sustainability Committee, Risk Management Committee, Management Committee, and Board of Directors as needed.

In addition, since fiscal 2019, the Group has been requiring that directors, including the CEO, maintain a strong awareness of the need to adapt to changes in society and the needs of the times under their selection criteria, and it has incorporated the sustainability and ESG perspectives, such as climate change, into decisions on director compensation. In our director compensation system, the degree of achievement of sustainability targets, including measures to respond to climate change, in the business areas under the control of each director, is incorporated into the evaluation criteria. Also, the system calculates variable compensation according to the degree of achievement of roles related to sustainability and ESG assigned to each director.

Starting in fiscal 2022, the policy for deciding on the details of the compensation, etc., for each individual director, excluding Audit & Supervisory Committee members, will be revised, and the details and calculation method for performance indicators and other considerations relating to bonuses as monetary compensation would retain a central emphasis on performance evaluation in terms of consolidated business profit and other factors, as well as including an evaluation based on non-financial indicators (e.g., sustainability factors). The reason for this is to raise director awareness of sustainability. For fiscal 2022, we plan to conduct an evaluation using non-financial indicators based on BEI*.

The Building Energy-efficiency Index is an index that evaluates the energy-saving performance of buildings based on the energy-saving standards of the Act on the Improvement of Energy Consumption Performance of Buildings (Building Energy Efficiency Act). It indicates the level of primary energy consumption of a given building.

Strategies

Upon considering climate change strategies, the Group conducted a qualitative scenario analysis based on the IPCC Fifth Assessment Report* and the details of the Paris Agreement. In the analysis, we examine the risks and opportunities that may be presented to the Group as a result of climate change and consider and implement strategies and policies that capture such risks and opportunities.

The Sixth Assessment Report of the IPCC released in August 2021 will also be used for analysis in future fiscal years.

Scope of Analysis

The Group consists of the Residential Development Business Unit (development and sales of condominiums and detached houses), Commercial Real Estate Business Unit (development, leasing, and sales of office buildings, commercial facilities, logistics facilities, and hotels), Investment Management Business Unit (management of REIT and private funds), Brokerage and CRE Unit (real estate brokerage), Operations and Management Unit (real estate management), and others (overseas), which are all included in the scope of analysis.

As for the calculation scope of GHG emissions, all of Scopes 1, 2, and 3 of the Group are covered.

Setting out scenarios

In the scenario analysis, the Group has adopted as its base case the 2°C scenario, assuming the achievement of the Paris Agreement and the realization of a decarbonized society. The 4°C scenario, a model in which climate change countermeasures do not make sufficient progress and the severity of natural disasters increases as a result, is also considered. The following documents were the main materials referred to in anticipating possible changes to the global environment under each scenario. The Group is also considering the 1.5°C scenario separately.

- ・Representative Concentration Pathway (RCP) 2.6 and 8.5 scenarios in the UN IPCC Fifth Assessment Report

- ・United Nations IPCC Sixth Assessment Report (2021)

- ・Sustainable Development Scenario (SDS) and Stated Policies Scenario (STEPS) in the IEA World Energy Outlook (2020)

Possible changes to the global environment under each scenario

Under each scenario, we have established an image of the world in 2050 for the 2°C and 4°C scenarios. (The 1.5°C scenario is examined separately.)

| Items | 2°C Scenario | 4°C Scenario |

|---|---|---|

| Sea level rise | 0.3–0.5 m

|

0.4–0.8 m

|

| Typhoon | Increase (Japan)

|

Significant increase (Japan)

|

| Flood | Increase (Japan: about two times as much)

|

Significant increase (Japan: about four times as much)

|

| Midsummer days | Increase (Japan: by about 10 days)

|

Significant increase (Japan: by about 50 days)

|

| Laws and regulations | Progress in enforcing extremely strict regulations

|

Limited regulatory impact

|

| Technology | Progress in the adoption of decarbonization technologies, ZEH and ZEB, and renewable energies

|

No progress in the adoption of decarbonization technologies, ZEH and ZEB, and renewable energies

|

| Customers | About a 50% reduction in energy consumption in offices where the adoption of ZEH, ZEB, and renewable energies is progressing

|

Limited adoption of ZEH, ZEB, renewable energies, etc. About a 20% reduction in energy consumption in offices |

Identification of Risks (and Opportunities)

The TCFD recommendations classify climate change risks into transition risks (policy and legal, technology, market, and reputation) and physical risks (acute and chronic). The Group has accordingly identified the impacts of these risks on the Group. This section describes the representative impacts of each risk category.

| Category | Impact on the Group | Our understanding | ||

|---|---|---|---|---|

| Large | Small | Risks | Opportunities | |

| Transition risks | Policy and regulatory risk

|

Implementation and/or strengthening of GHG emissions reduction regulations in business and property units (Scopes 1, 2)Expected cases

|

○ | ○ |

| Market risk

|

Delay in energy efficiency improvements for properties (buildings, housing, etc.) and in development or introduction of decarbonization technologiesExpected cases

|

○ | ○ | |

| Reputational risk

|

Rise in customer demand for functions related to the environment, energy saving, and disaster preventionExpected cases

|

○ | ○ | |

| Technical risk

|

Risk of the Group’s initiatives and businesses not being appreciated by investors and consumersExpected cases

|

○ | ○ | |

| Physical risks | Acute physical risk

|

Damages due to natural disasters such as typhoons, floods, and torrential rainExpected cases

|

○ | |

| Chronic physical risk

|

Impact of a rise in the average temperature on business Impact on real estate appraisal due to the manifestation of a rise in sea levels Expected cases

|

○ | ||

In addition to the qualitative analysis described above, the following quantitative analysis is underway. We intend to further strengthen our quantitative disclosures.

| Financial Impact (Cumulative) Expected up to 2030 | Quantitative Impact (Maximum Figure) | |

|---|---|---|

| Risk | Rise in non-life insurance premiums due to an increase in natural disasters | ¥6.0 million |

| Introduction of carbon pricing and/or carbon tax | ¥1.5 billion | |

| Opportunity | Decrease in financing costs due to the achievement of CO2 reduction targets | ¥150 million |

| Decrease in energy costs due to the greater environmental performance of buildings | ¥0.9 billion |

Risk Management

Matters related to climate change, including risk management, are overseen by the Board of Directors and the Management Committee and discussed in detail by the subordinate committees, Sustainability Committee, and Risk Management Committee. In addition, individual business matters, including business planning and product planning, are managed by each business unit.

The Sustainability Committee deliberates Group-wide policies and targets on climate change and discusses the risks and opportunities of climate change for the entire Group.

In addition, risks related to climate change are managed within the Group’s risk management system. To discuss various risks related to Group management, we have designated the Management Committee as the integrated risk management body, and we operate a system to regularly monitor, evaluate, and analyze the state of major risks while periodically reporting details to the Board of Directors.

Business units also individually investigate and address risks related to the market (client companies and consumers) and laws and regulations on construction and real estate, and they reflect the results of their investigations in the planning of businesses and products as needed. Of the matters examined, those that have a significant impact on the Group as a whole are reported to the Board of Directors, Management Committee, Sustainability Committee, and Risk Management Committee as appropriate, depending on specific content.

Metrics and Targets

The Group has set the following three targets to promote its response to climate change and has also identified the indicators described below for greenhouse gases.

-

Reduction of Greenhouse Gases (GHG and CO2)

Medium- to Long-term Targets Certified by the SBT (Science Based Targets) Initiative in November 2020

Reduce the total amount of GHG emissions from Scopes 1, 2, and 3 (Categories 1 and 11) by 35% by 2030 compared to the fiscal 2019 level.Short-term Target

Reduce the total amount of emissions from Scopes 1, 2, and 3 (Categories 1 and 11) by 15% by 2025 compared to the fiscal 2019 level.Scope 1: Direct emissions such as fuel combustion; Scope 2: Indirect emissions resulting from the use of electricity or heat purchased by the Company; Scope 3: Indirect emissions other than those in Scopes 1 and 2

Scope 3 targets cover Categories 1 (products and services purchased) and 11 (use of products sold). The GHG emissions of Category 1 cover approximately 94% of the total emissions of Scope 3 (FY2019).

-

Reduce Energy Use

-

Promote Solar Power Generation

Medium- to Long-term Targets

The power consumption of the entire Group will be 100% renewable electricity by 2050.

(Joined RE100 in January 2022)

Short-term Target

Switching electricity consumed by all leasing properties* owned by Nomura Real Estate Development to renewable electricity by fiscal 2023.

Excludes leasing properties (including the portion used by tenants) for which Nomura Real Estate Development has concluded direct electricity supply contracts with power companies, properties that Nomura Real Estate Development owns units in or are jointly owned with other parties, and properties planned to be sold or demolished, as well as the common use areas of some rental housing.

The Group will in principle promote measures to respond to climate change by collecting data on GHG (CO₂) emissions for all properties owned and sold by the Group as a whole and reducing the GHG emissions of the entire Group by compiling and monitoring the results. We will also look into setting an ultra-long-term target to achieve carbon neutrality by 2050. For the results related to climate change, please refer to the following.

Results for Medium- to Long-term Targets (2030 Targets)

(Unit:t-CO2)

| FY2019 (base year) |

FY2020 | FY2021 | |||

|---|---|---|---|---|---|

| Reduction Rate (Compared to FY2019) |

Reduction Rate (Compared to FY2019) |

||||

| Scope1 | 23,627 | 20,119 | - 14.8% | 21,542 | - 8.8% |

| Scope2 | 126,960 | 112,087 | - 11.7% | 107,514 | - 15.3% |

| Scopes 1 and 2 (totals) | 150,588 | 132,206 | - 12.2% | 129,056 | - 14.2% |

| 1: Purchased products and services | 969,704 | 453,707 | - 53.2% | 702,271 | - 27.5% |

| 11: Use of products sold | 2,203,005 | 834,184 | - 62.1% | 1,214,723 | - 44.8% |

| Scope 3 (totals) Note: Targeted only | 3,172,709 | 1,287,891 | - 59.4% | 1,916,994 | - 39.6% |

Third-party Assurance

We have asked Lloyd’s Register Quality Assurance Ltd. to provide assurance on the GHG emissions and energy use data for the entire Group.

Reference: Performance on Other Climate Change-Related Issues

(1) GHG emissions performance in Scopes 1 and 2

(Unit:t-CO2)

| FY2018 | FY2019 (Base Year) |

FY2020 | FY2021 | |

|---|---|---|---|---|

| Scope1 | 24,018 | 23,627 | 20,119 | 21,542 |

| Scope2 | 136,569 | 126,960 | 112,087 | 107,514 |

| Scopes 1 and 2 (totals) | 160,586 | 150,588 | 132,206 | 129,056 |

(2) GHG emissions performance by all items in Scope 3

(Unit:t-CO2)

| FY2019 (Base Year) |

FY2020 | FY2021 | |||

|---|---|---|---|---|---|

| Reduction Rate (Compared to FY2019) |

Reduction Rate (Compared to FY2019) |

||||

| 1: Products and services purchased | 969,704 | 453,707 | - 53.2% | 702,271 | - 27.5% |

| 2: Capital goods | 71,164 | 97,862 | + 37.5% | 159,373 | + 123.9% |

| 3: Fuel- and energy-related activities not included in Scopes 1 and 2 | 27,473 | 24,854 | - 9.5% | 24,358 | - 11.3% |

| 4: Transportation and delivery (upstream) | 4,081 | 3,164 | - 22.4% | 4,465 | + 9.4% |

| 5: Waste generated by businesses | 6,858 | 5,317 | - 22.4% | 7,503 | + 9.4% |

| 6: Business trips | 1,421 | 936 | - 34.1% | 963 | - 32.2% |

| 7: Employers’ commuting | 2,395 | 2,409 | + 0.5% | 1,917 | - 19.9% |

| 8: Lease assets (upstream) | ― | ― | ― | ― | ― |

| 9: Transportation and delivery (downstream) | ― | ― | ― | ― | ― |

| 10: Processing of products sold | ― | ― | ― | ― | ― |

| 11: Use of products sold | 2,203,005 | 834,184 | - 62.1% | 1,214,723 | - 44.8% |

| 12: Disposal of products sold | 62,603 | 19,605 | - 68.6% | 38,859 | - 37.9% |

| 13: Lease assets (downstream) | 19,011 | 14,025 | - 26.2% | 13,539 | - 28.7% |

| 14: Franchise | ― | ― | ― | ― | ― |

| 15: Investments | ― | ― | ― | ― | ― |

| Scope 3 (totals) | 3,367,714 | 1,456,063 | - 56.7% | 2,167,970 | - 35.6% |

(3) Energy use performance in properties subject to reporting under the Act on the Rational Use of Energy

| FY2018 | FY2019 | FY2020 | FY2021 | |

|---|---|---|---|---|

| Energy use (MWh/year) | 445,772 | 422,490 | 381,817 | 379,428 |

| Energy use intensity* (MWh/m²/year) | 0.224 | 0.208 | 0.184 | 0.182 |

For the calculation of the energy use intensity, the energy use is divided by the gross floor area of a property subject to reporting under the Act on the Rational Use of Energy (property subject to reporting on energy saving).

The Group is striving to reduce CO2 emissions through the three approaches of energy conservation, low-carbon buildings, and renewable energy.

(4) Energy Conservation Initiatives

(4-1) ZEH (Net Zero Energy House) initiatives

The Group is developing ZEHs* in condominiums from the perspective of comprehensive environment impact reduction.

In fiscal 2020, the PROUD Tower Kameido Cross Gate Tower was adopted as a Ministry of Economy, Trade and Industry Superhigh-rise ZEH-M Demonstration Project, and the Kagurazaka Fukuromachi Plan (tentative name) and Musashiurawa Station Plan (tentative name) were adopted as a Ministry of the Environment High-rise ZEH-M Support Project.

Homes designed to achieve a net zero annual primary energy consumption by greatly improving the insulation performance of the building envelope, installing highly efficient facilities and equipment to maintain the quality of the indoor environment, substantially reducing energy consumption, and then introducing renewable energy.

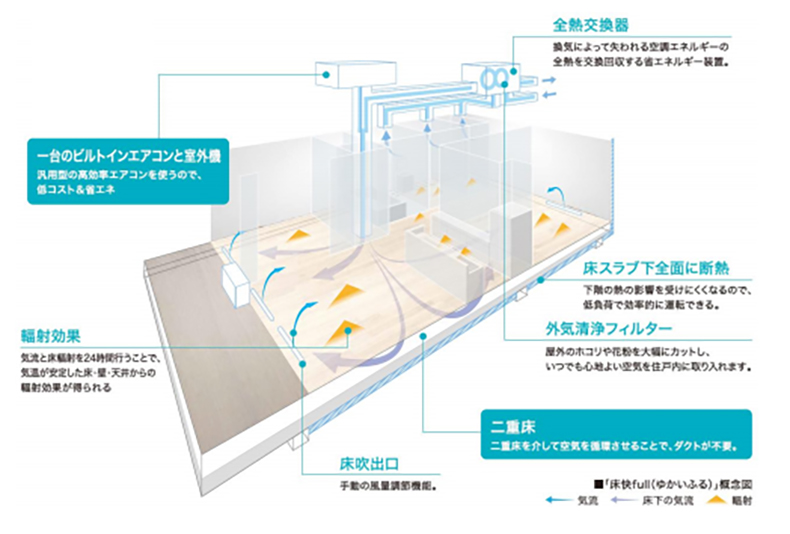

“Yukai-full” Offering Both Environmental Performance and Healthy, Comfortable Living

In order to deliver the energy-saving performance of ZEH-M, we have adopted “Yukai-full” in PROUD Takadanobaba and PROUD Tower Kameido Cross. The “Yukai-full” system uses the double floor as a pathway for heating, cooling, and ventilation, sending air conditioner breezes and fresh outside air throughout the entire dwelling, which keeps the entire place comfortable 24 hours a day, 365 days a year. This contributes to maintaining the overall health of the residents by reducing the risk of heat stress and heatstroke. In addition, the system can be operated at a lower temperature setting than usual when residents are out of the building, thereby saving energy while maintaining comfort and improving energy efficiency.

(4-2) Initiatives for obtaining green building certifications

The Group seeks to obtain environmental, green building certifications for new construction and owned properties including DBJ Green Building*1, LEED*2, CASBEE*3, and BELS*4.

Quantified target: acquisition rate of green building certifications for newly constructed fixed assets and income-producing properties (excluding rental housing): 100%

DBJ Green Building

A certification system, run by the Development Bank of Japan, that is aimed at promoting real estate that contributes to the environment and society.

LEED

A certification system developed and run by the U.S. Green Building Council (USGBC). Certification is granted to environment-friendly buildings.

CASBEE

A comprehensive assessment system for built environment efficiency. It includes a certification system run by the Institute for Built Environment and Carbon Neutral for SDGs (IBEC) and others, and assessment systems by local governments.

BELS

A building-housing energy efficiency labeling system established by the Ministry of Land, Infrastructure, Transport and Tourism. The energy efficiency of properties and housing is evaluated and certified by a third-party assessment organization.

(4-3) Environmental performance assessment during product planning and design

The Group provides products and services that address climate change in accordance with the Design and Construction Standards and the Quality Manual. Thermal insulation performance rating* of level 4 (the highest level), double-glazed windows (end panel eco-glass), LED lighting fixtures, and other features are set as standard specifications for PROUD condominiums, and Environmental Assessment and Challenge Sheets are used to improve the environmental performance.

A housing performance evaluation system pursuant to the Housing Quality Assurance Act. Levels indicate performance in the thermal environment.

(4-4) Helping customers to save energy

The Group not only strives to reduce CO2 emissions from buildings; it also helps condominium residents and tenant companies to save energy. Specifically, the Group provides a system that calculates total energy consumption and a system that makes it possible to visualize the amount of energy used, realizes energy savings using the enecoQ system, and provides eco-information via a member newsletter.

(4-5) Reduction of chlorofluorocarbons

To reduce the usage of ozone layer-depleting chlorofluorocarbons, the Group established a quality manual that requires the use of chlorofluorocarbon-free insulation and air conditioner refrigerants. Construction partners are also required to submit a Quality Control Check Sheet during construction to confirm that only chlorofluorocarbon-free materials are used.

(5) Low-carbon Buildings (Timber-based Construction, Absorption, and Fixation of CO2)

(5-1) Timber supply chain

The self-sufficiency rate for timber in Japan is currently over 40% but remains low compared to other countries, and the Forestry Agency’s White Paper on Forestry and Forest Products has set a target of achieving 50% self-sufficiency in timber by 2025.

One reason for the low self-sufficiency rate is that the supply chain for domestic timber, from upstream to downstream, is not fully functional. Despite the rich domestic resources that are available, there are cases in which timber that has reached its usable age is not being felled due to a failure to secure a buyer.

In response, the Company has entered into an Agreement on the Promotion of Timber Use in Buildings with both the Ministry of Agriculture, Forestry and Fisheries and Wing Co. Ltd. to develop a stable supply chain from upstream to downstream for domestic timber. Over the next five years, we will gradually promote the use of domestic timber for construction materials in the Group’s businesses, using a total of 10,000 m3 of domestic timber before the agreement ends, while Wing Co. Ltd. will work in cooperation with logging, manufacturing, and processing companies nationwide to ensure a stable supply of domestic timber.

All businesses involved in upstream, midstream, and downstream of this supply chain will work together to promote the use of domestic timber, thereby revitalizing Japan’s mountain villages and maintaining the forest cycle. Through the initiative, we will also contribute to establishing a forest cycle that serves multifaceted functions, such as promoting the absorption and fixation of CO2 and preserving biodiversity.

(6) Renewable energy initiatives

(6-1) Solar power generation business in the logistics facilities

The Group is promoting the Solar Power Generation Business. As of the end of March 2022, solar panels were installed on a total of 19 buildings at Landport logistics facilities, with annual output of 22,801 thousand kWh/year for fiscal 2021.

| FY2018 | FY2019 | FY2020 | FY2021 | |

|---|---|---|---|---|

| Solar power generating facility installation rate at Landport logistics facilities (%) | 92.9% | 94.7% | 90.0% | 76.0% |

| Electric power generated at Landport logistics facilities (thousand kWh/year) | 12,081 | 15,194 | 21,926 | 22,801 |

(6-2) Introducing solar power generation to detached housing

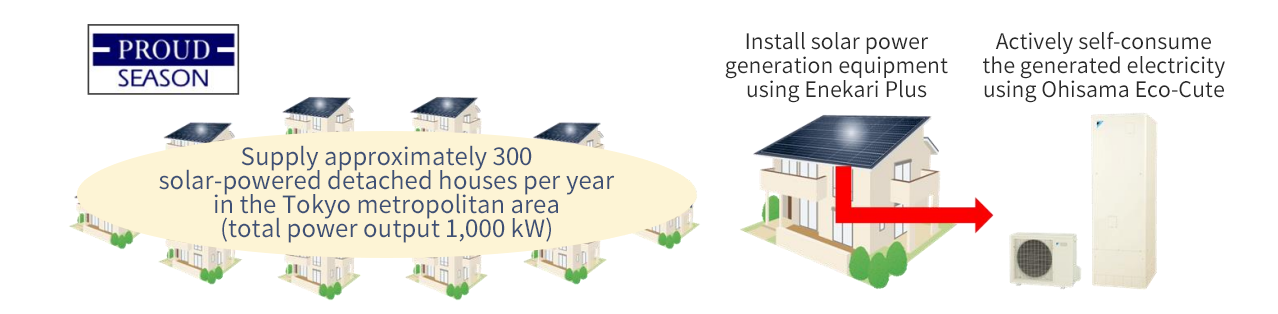

Using TEPCO Energy Partner’s solar PPA service “Enekari Plus” in May 2022, Nomura Real Estate Development launched the Virtual Mega Solar project, introducing solar power generation on the same scale as mega solar power plants (total power output of 1,000 kW) for PROUD SEASON detached housing developed by Nomura Real Estate Development, mainly in the Tokyo Metropolitan Area. This is the first initiative in Japan to introduce solar power generation with a total output of 1,000 kW to detached housing in the Tokyo metropolitan area (300 houses per year on the roof of the PROUD Season houses), and the two companies will promote this initiative for localized generation and consumption of electric power to conserve and generate energy in the Tokyo metropolitan area, where there are few areas of fallow land to be utilized.

By bringing in TEPCO EP’s Enekari Plus to approximately 300 PROUD SEASON houses of Nomura Real Estate Development per year, we will generate renewable energy, which achieves additionality on the same scale as mega solar power generation in residential areas in the metropolitan area. PROUD SEASON owners can use the energy generated by the solar power equipment for the duration of the Enekari Plus contract (ten years) without incurring initial or monthly costs. When the contract ends, they will also get to own the solar power generation equipment free of charge. Furthermore, using the solar power equipment in conjunction with an Ohisama Eco-Cute electric water heater promotes self-consumption of the generated electricity and reduces the amount of electricity purchased from the power company, thus suppressing the rise in electricity and gas bills caused by recent fuel price hikes. In the event of a disaster, they can continue to use electricity during the hours when solar power generation can take place, as well as the hot water stored in the Ohisama Eco-Cute for general household use, making their lives more secure.

(6-3) Use of renewable energy

All of the electricity procured for all Noga Hotels operated by Nomura Real Estate Hotels, one of the Group’s businesses, Garden Hotels operated by UHM, a Group company, and MEFULL, a commercial facility specializing in services developed by Nomura Real Estate Development, is practically 100% renewable under the Zero CO2 Plan provided by NF Power Service, a retail electricity provider and Group affiliate. In fiscal 2020, combined with other buildings, a total of 6,880,000 kWh of renewable energy was procured via this plan. In addition, we purchase one million kWh of green electricity per year for the Nihonbashi Muromachi Nomura Building.

(7) Initiatives for the Shibaura 1-chome Project

The Shibaura 1-chome Project is a phased reconstruction project of a large-scale complex of offices, commercial facilities, hotels, and other facilities in Minato-ku, Tokyo, and it has been approved as a national strategic special zone.

Under the theme of creating a city for healthy and comfortable living, the project aims to realize both the ideal state of the next generation of tenant buildings and CO2 reduction by realizing a Wellness Office, achieving ZEB Oriented through various energy-saving measures and ultimately becoming carbon neutral by introducing electricity derived from renewable energy sources in the future. In recognition of this plan, the project was selected by the Ministry of Land, Infrastructure, Transport and Tourism as the leading projects program for sustainable buildings (CO2 reduction type) in 2021.

(8) Sustainable finance initiatives

In response to the needs of investors, financial institutions, and other stakeholders, we implement sustainable finance initiatives to promote initiatives related to sustainability and climate change throughout the Group.

-

Implementation of Sustainability Linked Loans (July 2021)

With the support of The Chiba Bank, Ltd., Nomura Real Estate Holdings established the Comprehensive SLL Framework for sustainability linked loans (SLL). On July 30, 2021, Nomura Real Estate Holdings raised funds from nine banks participating in the TSUBASA Alliance, a broad regional bank alliance, as the first procurement based on this framework.

The SLL requires coordination and agreement on individual requirements, such as Sustainability Performance Targets (SPTs). This framework provides a preferential interest rate based on the SBT certified mid- to long-term targets for 2030 (35% reduction in total GHG emissions in FY2030 compared to FY2019) set as SPTs, and if they are met by 2030.

To ensure the credibility of this framework, we have obtained a third-party evaluation from Rating and Investment Information, Inc. on compliance with the Sustainability Linked Loan Principles and the rationality of the SPTs set. -

Issuance of Sustainability Bonds (February 2021)

In February 2021, Nomura Real Estate Holdings issued ten billion yen of Sustainability Bonds as a means of procuring funds to be used for measures and projects that contribute to addressing both environmental and social issues.

When issuing the bonds, we formulated the Nomura Real Estate Group Sustainability Bond Framework and allocated the funds raised under the framework to eligible projects that contribute to addressing environmental and social issues.

To ensure the credibility of the framework, we have obtained third party evaluations from Vigeo Eiris, Japan Credit Rating Agency, Ltd. (JCR), and Rating and Investment Information, Inc. (R&I) on the compliance with the principles of the International Capital market Association (ICMA) Sustainability Bond Guidelines, etc.News Release 1 (Japanese only) News Release 2 (Japanese only)

Sustainability

- The Nomura Real Estate Group’s Stance on Sustainability

- Climate Change and the Natural Environment

- Society and Employees

- ESG Data